kawaii fortune rabbit

kawaii fortune rabbit

In this technical article we’re going to take a quick look at the weekly Elliott Wave charts of Tesla (TSLA) , published in members area of the website. As many of our members are aware, the stock has given us good buying opportunities recently. The stock is showing impulsive bullish sequences in the cycle from the 138.63 low and we were calling for a further rally. In the following sections, we’ll delve into the Elliott Wave pattern and explain the forecast. TESLA H1 Update 11.04.2024 The stock has given us correction against the 212.12 low. The pullback has already reached the extreme zone at 245.17-233.93 and we believe pull back could be done. At this stage, we advise against selling the stock and favor the long side from the marked extreme zone. As the main trend is bullish, we believe TSLA could either see a rally toward new highs. TESLA H1 Update 11.12.2024 The stock responded exactly as expected. It found buyers at the Blue Box Area, making rally toward new highs. TESLA stock should ideally keep finding buyers in 3,7,11 swings against the 238.7 pivot. Keep in mind market is dynamic and presented view could have changed in the mean time.

kawaii fortune rabbit

In this technical article we’re going to take a quick look at the weekly Elliott Wave charts of Tesla (TSLA) , published in members area of the website. As many of our members are aware, the stock has given us good buying opportunities recently. The stock is showing impulsive bullish sequences in the cycle from the 138.63 low and we were calling for a further rally. In the following sections, we’ll delve into the Elliott Wave pattern and explain the forecast. TESLA H1 Update 11.04.2024 The stock has given us correction against the 212.12 low. The pullback has already reached the extreme zone at 245.17-233.93 and we believe pull back could be done. At this stage, we advise against selling the stock and favor the long side from the marked extreme zone. As the main trend is bullish, we believe TSLA could either see a rally toward new highs. TESLA H1 Update 11.12.2024 The stock responded exactly as expected. It found buyers at the Blue Box Area, making rally toward new highs. TESLA stock should ideally keep finding buyers in 3,7,11 swings against the 238.7 pivot. Keep in mind market is dynamic and presented view could have changed in the mean time.

GREELEY, Colo. , Dec. 23, 2024 /PRNewswire/ -- ALLO Fiber is pleased to announce its fiber broadband network build of the City of Boulder, CO. ALLO anticipates construction to begin in the spring of 2025 in city rights-of-way and easements. This fiber connection will enable world-class internet, broadband, cybersecurity, managed services, telephone, and video services for residents and businesses. City Manager Nuria Rivera-Vandermyde said, "We are thrilled to work with ALLO to bring affordable and reliable high-speed internet to every corner of Boulder. This partnership will provide significant benefits to our community. From empowering students and small businesses, to supporting remote work and ensuring that no one is left behind in the digital age." ALLO was founded in 2003, and over the last 21 years has expanded its fiber footprint to reach over one million in population, with a goal to end the digital divide. ALLO maintains a commitment to offering local, hassle-free products and services to the 48 communities it serves. ALLO Colorado General Manager Bob Beiersdorf stated, "We are extremely pleased to be building a world-class fiber to the premises (FTTP) network in Boulder . The opportunity to offer multi-gig, symmetrical speeds to residents, businesses, government, and the education community with consistent network reliability opens the door to immense possibilities for the city. Partnering with the City of Boulder is paramount in providing equitable services to its residents and that spirit of partnership has been exceptional to date." The fiber network will feature up to 10 Gigabit speeds for residents and up to 100 Gigabit speeds for businesses, providing equal upload and download speeds optimized by ALLO's world-class Wi-Fi 7 routers. Boulder residents, businesses of all sizes, and governmental entities will be supported by ALLO's fiber-rich network, which delivers active and passive solutions without installation fees or restrictive contracts. Internet, data transport, cloud connectivity, video, voice, next-generation firewalls, cybersecurity, and phone systems are included in ALLO's comprehensive communications, entertainment, and business products and services. Boulder is ALLO's eleventh market in Colorado . ALLO currently has customers in Breckenridge , Brighton , Brush , Eaton , Erie , Evans , Fort Morgan , Greeley , Hudson , and Kersey . Visit AlloFiber.com/ Boulder and AlloFiber.com/careers for more information. About ALLO Communications ALLO Communications, a leader in providing fiber-optic services, has been dedicated to delivering world-class communications and entertainment services since 2003. With a commitment to building Gigabit communities, ALLO serves over 50 communities across Nebraska , Colorado , Arizona , Missouri , Iowa , and Kansas . ALLO is known for reliable fiber networks and customized technology solutions that support businesses of all sizes. For more information, visit AlloFiber.com . Tanna Hanna Vice President of Marketing Tanna.Hanna@allofiber.com 308-633-7815 View original content to download multimedia: https://www.prnewswire.com/news-releases/the-power-of-allos-all-fiber-network-coming-to-boulder-colorado-302338556.html SOURCE ALLO Communications Best trending stories from the week. Success! An email has been sent to with a link to confirm list signup. Error! There was an error processing your request. You may occasionally receive promotions exclusive discounted subscription offers from the Roswell Daily Record. Feel free to cancel any time via the unsubscribe link in the newsletter you received. You can also control your newsletter options via your user dashboard by signing in.Texas, Arizona State to meet in CFP clash of old vs. new Big 12 champs

THE POWER OF ALLO'S ALL-FIBER NETWORK COMING TO FLAGSTAFF, ARIZONA* Top three candidates are all ''qualified adults,' analysts say * Kevin Warsh leads bets for Treasury secretary role * Investors worry about Fed independence under Trump administration By Davide Barbuscia Nov 22 - Investors are hoping President-elect Donald Trump will name a Treasury secretary soon who will assuage their concerns about the Republican's policy promises that have weighed on an already sagging U.S. government bond market. The benchmark U.S. 10-year yield, which moves inversely to bond prices, is hovering near a five-month high as traders fret about the potential for a rebound in inflation and increase in the federal budget deficit from Trump’s economic plans such as tax cuts and import tariffs. More recently, uncertainty over who will fill the Treasury role has added to investor concerns. The latest leg of the Treasury selloff is due to worries over “fiscal concerns, increased spending and Treasury secretary,” said George Catrambone, head of fixed income and trading at DWS. According to a Wall Street Journal report on Thursday, former investment banker Kevin Warsh, who served on the Federal Reserve Board, is one of Trump's Treasury secretary candidates on the understanding that he could later become Fed chairman. That deepened uncertainty and fueled investors’ hopes that a resolution would be quick in coming. Other top candidates include investor Scott Bessent and Apollo Global Management Chief Executive Marc Rowan. Wagers on who will get the job have drawn over $5 million in bets on the Polymarket prediction platform with Warsh in the lead, followed closely by Bessent. The Treasury secretary oversees U.S. economic and tax policy, and Trump's nominee will be tasked with carrying out his plans. As a result, the investment world, from global bond traders to U.S. corporate treasurers, is keenly interested in the individual's economic views and the kind of counsel they will give Trump behind closed doors. Campe Goodman, Wellington Management Company fixed income portfolio manager, said yields would ease if Trump nominated a Treasury secretary who makes a point of addressing worries that key Trump policies will add to the budget deficit and inflation. “I think whoever gets is probably going to talk a little more fiscally responsible than the market expects,” he said. “I think he’ll want someone who talks somewhat responsibly.” Analysts at BMO Capital Markets said investor anxiety over the pick has been comparatively subdued because all three top contenders “fall into the category of qualified adults in the room” though the market prefers the question be settled quickly. Investors are also focused on the new administration’s position on Fed independence since central bank policy is a key factor in Treasury price moves. Trump in August said the president should have a "say" in Fed decisions, and according to media reports, his allies have drafted proposals to erode the Fed's independence. "I hope the Fed stays independent because that’s good for the bond market,” said Goodman. This article was generated from an automated news agency feed without modifications to text.

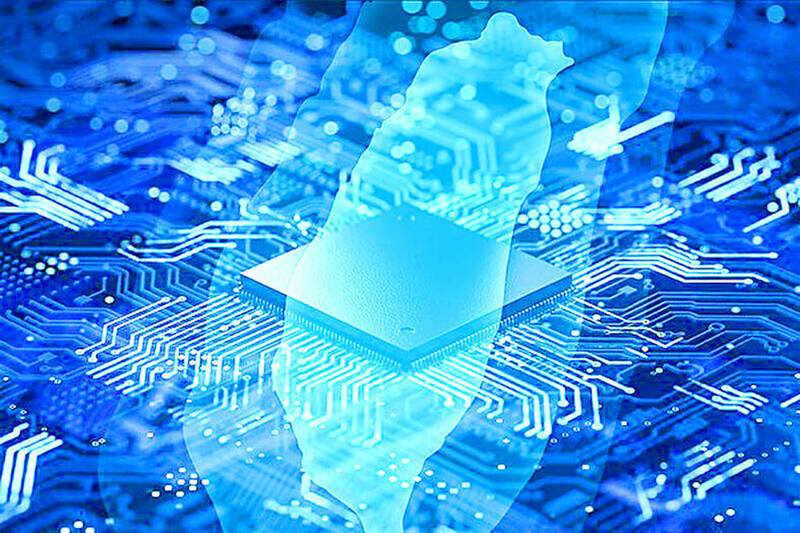

As the artificial intelligence revolution accelerates, two titans dominate the chip industry: Taiwan Semiconductor Manufacturing and Nvidia. Both have seen their stock prices soar, but which is the ultimate AI investment today? Spotlight on Taiwan Semiconductor Manufacturing (TSMC) While not as glamorous as AI-driven software companies, TSMC’s expertise in semiconductor production has proven vital. In Q3, its revenue surged by 36% to $23.5 billion, with earnings leaping by 54% to $1.94 per American Depository Receipt. These impressive results are fueled by tech giants’ significant investments in cutting-edge AI chips. The company’s strategy hinges on its advanced production techniques, including the recent introduction of 3-nanometer chips, and ambitious plans to begin 2-nanometer chip production in 2025. TSMC currently commands a 90% market share for the world’s most advanced processors, securing its leadership in semiconductor manufacturing as AI infrastructure spending soars. Nvidia’s Power Play Unlike TSMC, Nvidia excels in designing the semiconductors crucial for AI data centers. Recent demand spikes saw Nvidia’s Q3 sales rocket by 94% to $35.1 billion, with non-GAAP earnings climbing 103% to $0.81 per share. This growth was largely driven by a 112% increase in data center revenue. Nvidia’s CEO anticipates AI infrastructure spending might hit $2 trillion in the next five years, positioning the company to capitalize significantly on this trend. Nvidia’s chips currently power between 70% and 95% of AI data centers, cementing its dominance in the sector. The Winner: Taiwan Semiconductor Both companies dominate their niches, but for investors seeking value, TSMC may be the more attractive choice. With a forward P/E ratio of 23.0, it’s comparatively cheaper than Nvidia, which stands at 32.7. As AI technology evolves, both TSMC and Nvidia remain pivotal players. However, for those keen on a more cost-effective option, Taiwan Semiconductor emerges as the more appealing investment today. Investing in the AI Revolution: TSMC vs. Nvidia – Which Stock Holds the Edge? As artificial intelligence continues to reshape industries, Taiwan Semiconductor Manufacturing Company (TSMC) and Nvidia lead the charge in the chip sector, playing pivotal roles in the AI ecosystem. While TSMC excels in semiconductor production, Nvidia dominates in designing AI-centric semiconductors. Here’s a deeper dive into the investment potential of these two industry leaders. TSMC: Scaling New Heights with Advanced Semiconductor Manufacturing Specifications and Innovations TSMC’s strength lies in its mastery of semiconductor manufacturing. The company commands a staggering 90% market share in advanced processing chips, thanks to its innovative production techniques. Their recent rollout of the 3-nanometer chips and plans to advance to 2-nanometer chips by 2025 highlight their commitment to staying ahead technologically. Market Position and Strategy TSMC’s robust market position is bolstered by significant investments from tech giants seeking high-performance AI chips. This ensures steady revenue growth and secures TSMC’s leadership as a crucial supplier in the AI landscape. The company’s ambitious roadmap further fortifies its status in semiconductor advancements, crucial for AI infrastructure. Nvidia: Powering the AI Data Center Revolution Market Analysis and Growth Predictions Nvidia has established itself as a leader in designing semiconductors that empower AI data centers. Its recent performance saw revenues soaring by 94% to $35.1 billion, with a notable 112% increase in data center revenues. As AI infrastructure spending is predicted to reach $2 trillion within five years, Nvidia is strategically positioned to harness this expansion. Features and Compatibility Nvidia’s GPUs are integral to modern AI applications, powering between 70% and 95% of current AI data centers. This widespread adoption underscores their compatibility and essential role in AI computing tasks, enabling everything from complex calculations to real-time data processing. Investment Insights: Comparing TSMC and Nvidia Pros and Cons – TSMC : Offers investors a cost-effective entry with a forward P/E ratio of 23.0. Its leading market share and cutting-edge manufacturing position make it a strong contender for those focusing on value investments. – Nvidia : Although trading at a higher P/E ratio of 32.7, Nvidia’s strategic edge in the rapidly expanding AI data center domain could justify the premium. The potential ROI driven by significant AI infrastructure investment creates an attractive case for growth-focused investors. Use Cases and Compatibility Both companies are indispensable to the AI sector but cater to different needs. TSMC’s chips are foundational for AI hardware, while Nvidia’s designs are vital for the operational capabilities of AI systems, particularly in data-heavy environments. Future Predictions and Trends As AI technologies evolve, both TSMC and Nvidia are expected to remain pivotal. TSMC’s continued excellence in chip production and pioneering of smaller, more efficient chips will likely maintain their leadership. Nvidia’s dominance in AI-centered semiconductors means they are poised to capture significant portions of the forthcoming surge in AI infrastructure spending. For potential investors, those drawn to a comparatively undervalued yet fundamentally strong stock may favor TSMC. Meanwhile, those seeking growth opportunities in AI data processing could find Nvidia more appealing. For more insights about Nvidia, you can explore the official Nvidia website, and for TSMC, visit their official site .On Thursday, ( ) stock received a positive adjustment to its , from 66 to 73. IBD's proprietary RS Rating measures technical performance by using a 1 (worst) to 99 (best) score that indicates how a stock's price action over the last 52 weeks compares to other publicly traded companies. Decades of market research reveals that the best stocks tend to have an RS Rating of above 80 in the early stages of their moves. See if Arm Holdings stock can continue to rebound and hit that benchmark. Is Arm Holdings Stock A Buy? Arm Holdings stock is building a cup with handle with a 164.16 . See if the chip stock can break out in volume at least 40% higher than normal. The chip company showed -19% earnings growth in its most recent report, while sales growth came in at 5%. Arm Holdings stock earns the No. 11 rank among its peers in the Electronics-Semiconductor Fabless industry group. ( ), ( ) and ( ) are among the top 5 highly rated stocks within the group. For more industry news, check out " ."Independence Blue Cross launches Epic Payer Platform to transform care coordination and boost member health outcomes

Faruqi & Faruqi Reminds Chipotle Mexican Grill Investors Of The Pending Class Action Lawsuit With A Lead Plaintiff Deadline Of January 10, 2025 - CMG

India Did The Right Thing: When Manmohan Singh Backed Modi Govt's Stand On Russia-Ukraine WarIsrael strikes Houthi rebels in Yemen's capital while the WHO chief says he was meters away JERUSALEM (AP) — A new round of Israeli airstrikes in Yemen have targeted the Houthi rebel-held capital of Sanaa and multiple ports. The World Health Organization’s director-general said the bombardment on Thursday took place just “meters away” as he was about to board a flight in Sanaa. He says a crew member was hurt. The strikes followed several days of Houthi attacks and launches setting off sirens in Israel. Israel's military says it attacked infrastructure used by the Houthis at the international airport in Sanaa, power stations and ports. The Israeli military hasn't responded to questions about the WHO chief's statement. The US says it pushed retraction of a famine warning for north Gaza. Aid groups express concern. WASHINGTON (AP) — U.S. officials say they asked for — and got — the retraction of an independent monitor's warning of imminent famine in north Gaza. The internationally Famine Early Warning System Network issued the warning this week. The new report had warned that starvation deaths in north Gaza could reach famine levels as soon as next month. It cited what it called Israel's “near-total blockade” of food and water. The U.S. ambassador to Israel, Jacob Lew, criticized the finding as inaccurate and irresponsible. The U.S. Agency for International Development, which funds the famine-monitoring group, told the AP it had asked for and gotten the report's retraction. USAID officials tell The Associated Press that it had asked the group for greater review of discrepancies in some of the data. Trump has pressed for voting changes. GOP majorities in Congress will try to make that happen ATLANTA (AP) — Republicans in Congress plan to move quickly in their effort to overhaul the nation’s voting procedures, seeing an opportunity with control of the White House and both chambers of Congress. They want to push through long-sought changes such as voter ID and proof-of-citizenship requirements. They say the measures are needed to restore public confidence in elections. That's after an erosion of trust that Democrats note has been fueled by false claims from Donald Trump and his allies of widespread fraud in the 2020 election. Democrats say they are willing to work with the GOP but want any changes to make it easier, not harder, to vote. Americans are exhausted by political news. TV ratings and a new AP-NORC poll show they're tuning out NEW YORK (AP) — A lot of Americans, after an intense presidential election campaign, are looking for a break in political news. That's evident in cable television news ratings and a poll from The Associated Press-NORC Center for Public Affairs Research. The poll found nearly two-thirds of Americans saying they've found the need recently to cut down on their consumption of political and government news. That's particularly true among Democrats following President-elect Donald Trump's victory, although a significant number of Republicans and independents feel the same way. Cable networks MSNBC and CNN are really seeing a slump. That's also happened in years past for networks that particularly appeal to supporters of one candidate. Aviation experts say Russia's air defense fire likely caused Azerbaijan plane crash as nation mourns Aviation experts say that Russian air defense fire was likely responsible for the Azerbaijani plane crash the day before that killed 38 people and left all 29 survivors injured. Azerbaijan is observing a nationwide day of mourning on Thursday for the victims of the crash. Azerbaijan Airlines’ Embraer 190 was en route from Azerbaijan’s capital of Baku to the Russian city of Grozny in the North Caucasus on Wednesday when it was diverted for reasons yet unclear and crashed while making an attempt to land in Aktau in Kazakhstan. Cellphone footage circulating online appeared to show the aircraft making a steep descent before smashing into the ground in a fireball. India's former prime minister Manmohan Singh, architect of economic reforms, dies aged 92 NEW DELHI (AP) — India’s former Prime Minister Manmohan Singh, widely regarded as the architect of India’s economic reform program and a landmark nuclear deal with the United States, has died. He was 92. The hospital said Singh was admitted to New Delhi’s All India Institute of Medical Sciences late Thursday after his health deteriorated due to “sudden loss of consciousness at home." He was “being treated for age-related medical conditions,” the statement added. A mild-mannered technocrat, Singh became one of India’s longest-serving prime ministers for 10 years and earned a reputation as a man of great personal integrity. But his sterling image was tainted by allegations of corruption against his ministers. Ukraine's military intelligence says North Korean troops are suffering heavy battlefield losses KYIV, Ukraine (AP) — Ukraine's military intelligence says North Korean troops are suffering heavy losses in Russia's Kursk region and face logistical difficulties as a result of Ukrainian attacks. The intelligence agency said Thursday that Ukrainian strikes near Novoivanovka inflicted heavy casualties on North Korean units. Ukraine's president said earlier this week that 3,000 North Korean troops have been killed and wounded in the fighting in the Kursk region. It marked the first significant estimate by Ukraine of North Korean casualties several weeks after Kyiv announced that North Korea had sent 10,000 to 12,000 troops to Russia to help it in the almost 3-year war. How the stock market defied expectations again this year, by the numbers NEW YORK (AP) — What a wonderful year 2024 has been for investors. U.S. stocks ripped higher and carried the S&P 500 to records as the economy kept growing and the Federal Reserve began cutting interest rates. The benchmark index posted its first back-to-back annual gains of more than 20% since 1998. The year featured many familiar winners, such as Big Tech, which got even bigger as their stock prices kept growing. But it wasn’t just Apple, Nvidia and the like. Bitcoin and gold surged and “Roaring Kitty” reappeared to briefly reignite the meme stock craze. Holiday shoppers increased spending by 3.8% despite higher prices New data shows holiday sales rose this year even as Americans wrestled with still high prices in many grocery necessities and other financial worries. According to Mastercard SpendingPulse, holiday sales from the beginning of November through Christmas Eve climbed 3.8%, a faster pace than the 3.1% increase from a year earlier. The measure tracks all kinds of payments including cash and debit cards. This year, retailers were even more under the gun to get shoppers in to buy early and in bulk since there were five fewer days between Thanksgiving and Christmas. Mastercard SpendingPulse says the last five days of the season accounted for 10% of the spending. Sales of clothing, electronics and Jewelry rose. Why this Mexican American woman played a vital role in the US sacramental peyote trade MIRANDO CITY, Texas (AP) — Amada Cardenas, a Mexican American woman who lived in the tiny border town of Mirando City in South Texas, played an important role in the history of the peyote trade. She and her husband were the first federally licensed peyote dealers who harvested and sold the sacramental plant to followers of the Native American Church in the 1930s. After her husband's death in 1967, Cardenas continued to welcome generations of Native American Church members to her home until her death in 2005, just before her 101st birthday.

- Previous: fortune rabbit pg soft

- Next: pg fortune rabbit